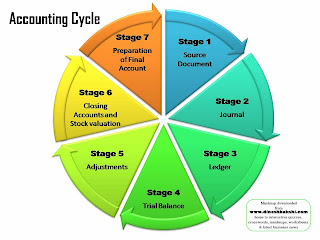

Has occurred is a source document such as a sales ticket, check, and so on. One fundamental criterion: They must have caused a measurable change in the amounts in theĪccounting equation, Assets = Liabilities + Stockholders' Equity. Party, such as the sale of a book, or they can involve paying salaries to employees. Measurable in terms that affect the solvency and profitability of the business.īusiness transactions can be the exchange of goods for cash between the business and an external These two events may briefly interrupt the operation of the business. For example,Īssume that the owner of a business spilled a pot of coffee in her office or broke her leg while skiing. Transactions are measurable events that affect the financial condition of a business. Before you can visualize theĮight steps in the accounting cycle, you must be able to recognize a business transaction. Throughout the period and some at the end) to analyze, record, classify, summarize, and report usefulįinancial information for the purpose of preparing financial statements.

Three steps of accounting process series#

All Rights Reserved.The accounting cycle is a series of steps performed during the accounting period (some More elaborate e-commerce applications involve planning and coordinating suppliers, customers, and the product design process.Ĭopyright © 2005 South-Western. E-commerce can be used to improve the speed and efficiency of the revenue/collection and purchase/payment cycles. B2C e-commerce involves Internet transactions between a business and consumer, while B2B e-commerce involves Internet transactions between a business and another business. Using the Internet to perform business transactions is termed e-commerce.

Three steps of accounting process manual#

Apply computerized accounting to the revenue and collection cycle.Ĭomputerized accounting systems are similar to manual accounting systems.For example, an additional column is often added to the revenue journal for recording the collection of sales taxes payable. Special journals may be modified by adding columns in which to record frequently occurring transactions. Subsidiary ledgers may be maintained for a variety of accounts, such as fixed assets, as well as accounts receivable and accounts payable. Describe and give examples of additional subsidiary ledgers and modified special journals.The use of each special journal and the accounts receivable and accounts payable subsidiary ledgers is illustrated in the chapter. The general journal is used for recording transactions that do not fit in any of the special journals. The cash payments journal is used to record all payments of cash. The purchases journal is used to record purchases on account. The cash receipts journal is used to record all receipts of cash. The revenue journal is used to record the sale of services on account. Special journals may be used to reduce the processing time and expense of recording a large number of similar transactions.

The sum of the balances of the accounts in a subsidiary ledger must agree with the balance of the related controlling account. Each subsidiary ledger is represented in the general ledger by a summarizing account, called a controlling account.

Subsidiary ledgers may be used to maintain separate records for each customer (the accounts receivable subsidiary ledger) and creditor (the accounts payable subsidiary ledger).

0 kommentar(er)

0 kommentar(er)